Canada, slightly larger than the U.S. but with an eighth of the population, has dozens of manufacturers, installers, and modifiers of overhead cranes.

Among them is Givens Engineering, based in London, Ontario. However, unlike most manufacturers, which build steel cranes, Givens focuses on lightweight aluminum cranes “that you can set up on a weekend,” said company founder and president Ray Givens.

These enclosed-track cranes, with capacities of about two tons, are very popular in the automotive industry, Givens said. He estimated that in eastern Canada, such lightweight cranes account for about half of the overhead cranes sold today.

For Givens, about 50% of its production is shipped to the U.S. The company, with about 80 employees, has a 50,000 square foot manufacturing plant in London, a second 26,000 square foot plant in London, and a 22,000 square foot fabricating facility in Perrysburg, Ohio.

About 65% of Givens cranes work in the automotive sector with the remainder in sectors like aerospace, defence industries, agriculture and construction.

“The automotive industry is so huge in the United States that the demand is limitless,” Givens said.

Quebec hoist maker notes industry consolidation

In Quebec, Alain Giasson, owner of Montrealbased Vulcan Hoist Company, said industry consolidation is resulting in fewer and fewer hoist manufacturers.

“Hoist manufacturers are either being purchased by larger hoist companies, or as we are seeing more and more, private equity is wanting to get an important presence in the industrial market,” Giasson said.

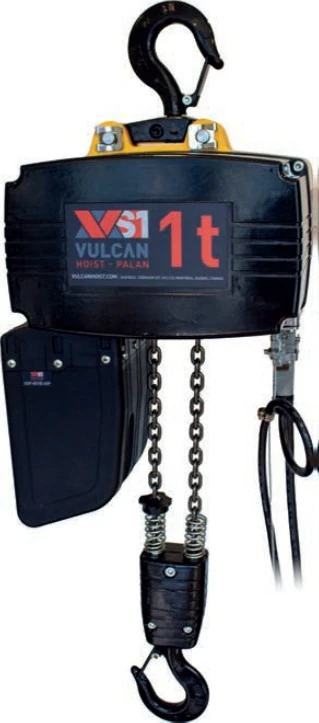

Canada’s only chain-hoist manufacturer, Vulcan employs about 40 people and has a main manufacturing facility of 15,000 square feet. Among Vulcan’s recent innovations is its Vulcan VS1 hoist, which can run on three voltages: 115-volts, 230-volts one-phase, and 230-volts three-phase.

“So the distributor can decide to sell it to customer A, B or C, because it’s more versatile” Giasson said. “It serves many needs.”

Vulcan, which is marking 60 years in business, also has a partnership with a Swiss company, GIS, that supplies products such as explosion-proof and food-grade hoists.

“If we don’t do this, if we don’t fulfill every customer order, then we’re not the right guy to go to,” Giasson said.

Manufacturing, mining, shipbuilding and forestry are among the major industries for Vulcan products. Giasson admitted, though, that he doesn’t always know the hoist’s final user. For example, many are shipped to distributors in Edmonton, where he expects they are used to support the oil sands sector.

Alberta cranes in high demand

“There’s a huge demand; cranes are everywhere,” said Lisa Demer-Olver, owner of Edmonton-based Kolo Training. For large operations like mines, big multinationals like Konecranes build complete overhead cranes. However, many smaller companies, such as WF Steel & Crane, build custom overhead cranes that incorporate hoists and trollies from other manufacturers.

“What they’re manufacturing is the runways and the bridges,” Demer-Olver said. “And then they put on whatever the client wants.”

Many Alberta crane companies will also purchase pre-engineered kits and install them.

“You’ll see them in the oil fields for their compressor stations and their batteries,” Demer- Olver said.

In addition to training overhead crane operators, Demer-Olver is chairing a subcommittee of the Canadian Standards Association that is reviewing and updating an existing national standard for overhead cranes, CSA B-167.

“It should be ready for public review in 18 months,” Demer-Olver said.

Winnipeger cites technician challenges

In central Canada, Holly Lucenkiw, general manager of Century Cranes & Services in Winnipeg, said the biggest challenges are sourcing materials, such as electronics parts, and finding skilled staff, particularly for the service and inspection side of the business.

“No one really goes to school to be a crane technician,” she said.

Despite having only four employees, Century covers all of Manitoba and also does work in Saskatchewan and northwest Ontario. The company, which has a 15,000 square foot facility in Winnipeg, doesn’t export to the U.S. although a lot of its crane components are from U.S. manufacturers like Demag.

Century works in such varied industries as aviation, railways, and manufacturing. And it can assemble of variety of cranes, including toprunning, under-running, or monorail-beam styles.

One trend Lucenkiw has noticed is Bluetooth technology, which has also captured the attention of Keith Ellis, general manager of Norelco Industries on the Pacific coast, in Surrey, B.C.

“You can basically diagnose and troubleshoot from the floor without going up to the crane,” Ellis said.

B.C. crane builder goes underground

Norelco serves the Canadian market almost exclusively, in such industries as forestry and mining. The latter included installing overhead cranes in an underground cavern at the New Afton Mine near Kamloops.

“It’s a challenge to get them down there,” Ellis said. “These are short-span, heavy capacity cranes. And they get them way down, miles underground.”

Norelco’s biggest challenge lately is also finding qualified technicians — who are proficient at both electrical and mechanical work.

The company, with about a dozen employees, has a 10,000 square foot facility with two bays each with two 10-ton cranes. For much of its work, cranes of up to 25 tons, Norelco installs kits from its hoist supplier, R&M, that also include end trucks and all the electronics.

“It’s like a plug-and-play. We’ll fabricate the girders and then put it all together and paint it and wire it,” Ellis said.

Atlantic company welcomes modular home uptick

Across the country, at Atlantic Crane & Material Handling, 99.9% of its business is also in Canada, noted general manager Ian Reid. Headquartered in Dartmouth, Nova Scotia, Atlantic also has operations at Mt. Pearl, Newfoundland, and St. John, New Brunswick. Since 2021, the company has operated as a division of Hercules SLR.

“A lot of our infrastructure across the country, whether it be private or public sector, was built in the 1950s to 1970s,” Reid said. “It’s coming to its useful end of life. There’s a lot of opportunity there.”

Reid also noted that people are looking for more automation within standard overhead cranes, something he expects advances in artificial intelligence will enhance in the years ahead.

“The clients send us a drawing of their building and say they need a solution, and we go from there,” Reid said.

Atlantic fabricates cranes of capacities from 50 kilograms to 200 tons for industries ranging from aerospace, power generation, boat building, and modular home construction.

“There’s been a huge uptick in the modular home industry because it is the most efficient method, as well as environmentally friendly way to get these homes built,” Reid said.

As elsewhere in Canada, a major challenge for Atlantic is finding certified technicians.

“It takes a few years to grow them,” Reid said. “Without a steady stream of those, it’s hard to get that work done.”