If the past few years have taught us anything, it’s to expect change. Economic shifts, technological leaps, public health crises, and geopolitical conflicts can change the way things work and what customers expect. Whether you’re a manufacturer, fabricator, or distributor, to continue growing, you need to change, too. That means evolving your business model.

A business model has two parts: Adding value to a group of customers, and Extracting value – ie getting paid. Today, companies that successfully create value are those that change their business model to meet the moment, while companies that stick to tradition get left behind.

It comes down to economic gross margin, which is created by customers switching costs. When your customers don’t see any barriers preventing them from switching to another provider, you’ll experience low gross margins and less growth. To create a competitive advantage, improve your value proposition to increase those switching costs. But here’s the challenging part: You can’t expect anything to be driven from your sales function. For example, is your customer just buying a sling? Or are they buying the sling and a risk mitigation policy that you’ve bundled into the package? Only the latter scenario can provide enough value for customers to make switching no longer worth the hassle.

If you’re just selling slings, you’re falling behind. In the modern market, you need to be willing to make significant front-end investments in new activities that have the potential to actually create a competitive advantage for your company.

For decades, the market was healthy and stable enough that manufacturers and distributors could thrive by simply adopting best practices. Everyone did the same thing, and it just came down to who was the best at them. Now, you must look at what your competitors aren’t doing and beat them to the punch.

What’s behind this significant shift? Well, competitive intensity and pricing transparency have increased significantly, and when that happens, margins always decline. As a result, lowering your recurring cost to serve is the most crucial driver for growth. And you can do that by finding new, more nimble ways to deliver value.

Then there’s the appeal of field sales. Even before the pandemic, a younger generation raised on ecommerce entered the B2B space expecting to be able to shop online. Then COVID hit and made in-person sales unviable for a significant period. Boomers who still cared about having personal relationships with their vendors retired, and everyone else realized they didn’t really want or need traditional relationships with their vendors. In many cases, those old best practices – sales skills, relationships, promotions – mattered a lot less. What mattered was being able to sell five points cheaper than the competition or add value to the sale, which you can only do if you’re bold enough to make significant investments in new activities over a three- to five-year period. In other words, you need to play the game to win.

The Rise of Big Data

Old school firms still have great storytelling skills, but the stories they tell are mostly opinions backed by emotional conviction, not hard data. That won’t fly anymore.

Manufacturers and distributors have always generated lots of data in their day-to-day work. What’s changed is technology. Now, high-tech software can help firms collect, analyze, and utilize data more efficiently and effectively than ever before. The more advanced your company is, the more likely you’ll be able to discover a new business model that creates a real competitive advantage.

When it comes to data analytics, companies can be split into five levels:

- Level 1: I won’t even bother describing. Quite frankly, if you’re still here in 2024, you’re dead in the water.

- Level 2: Data Siloed. You’re still relying on internal data sets, but you’re at least conducting pattern analysis and tracking changes, making ongoing investments in data scrubbing, and creating public dashboards and scorecards on multiple KPIs. You may even be adopting some low-level AI tools.

- Level 3: External Data Integration. You’ve added external non-ERP data to your existing internal data sets, creating a data integrity improvement feedback loop. For example, investing in data analysis on annual wire rope consumption by state and company. This generates opportunities by identifying wallet share values, underserved markets, and the potential to improve your alignment of resources to market size and structure. At the same time, you’re engaging and integrating business processes with customers and suppliers, taking the friction out of their processes. (Most companies are either here or on level 4.)

- Level 4: Interdependent Data Applications. At this level, big data management has become a competitive advantage, and the insights you’ve developed can be leveraged beyond the core enterprise. You can help customers get customers for their customers while moving up the value stream by providing insights to key suppliers on market behaviors and competitive positioning.

- Level 5: Best in Class. Less than 3% of firms have made it here, where marketing owns the front end of the sales funnel and is fully integrated with the field, while inside sales does most of the market serving. The field sales team is management-directed, only making qualified sales calls set up by marketing and inside sales.

These companies broaden their base and increase their wallet share by spending time on opportunity, not revenue. Generalist field sales reps have become specialists and experts on how their customers choose to buy. And digitally enabled inside selling resources provide most of the company’s market-serving activities.

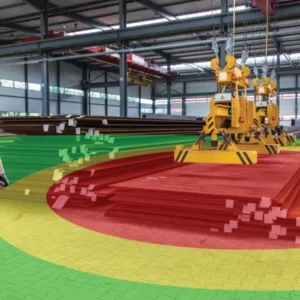

Level 5 companies might as well be playing a different game altogether. Their website and ERP is directly linked to their main customers’ ERP systems, and they often manage their customers’ social media marketing, too. Phone calls are replaced with advanced applications, enterprise texting, and other tech-forward approaches that enable 24/7/365 service. And their inventory automatically migrates to high-demand areas, reducing working capital to sales ratios while improving fill rates. These companies have successfully gotten the decision-making close to the customer with accountability.

They’ve also managed to level up by finding the best applications for artificial intelligence, such as: Pricing negotiations where >80% is approved at the first pass; Building complex quotes from provided lists; Scheduling deliveries and truck loading sequences; Lights out order processing; Evaluating incoming leads; Expediting delayed shipments. To make it to the top, you need to invest in data analytics, AI, and whatever else is necessary for a radical shift in how you do business.

Don’t get confused: The rise of big data and AI doesn’t mean that you should focus exclusively on technology. Human beings are still the beating heart of any business operation. If you’re going to grow, your evolving business model needs to include a fresh approach to talent management.

Old school firms tend to wax poetic about the virtues of loyalty. Well, if you want loyalty, I suggest getting a dog. Younger generations of workers are much more willing to leave a company behind if their needs aren’t being met.

According to McKinsey, employers are overlooking the relational elements that employees place the most importance on. They want to be valued, they want a sense of belonging, and they want opportunities to advance. When they don’t get those things, they leave—and employers are often left scratching their heads because this doesn’t line up with their assumptions.

I’ve been consulting for nearly four decades, and every single client has had at least one manager who was outgrown by position requirements, a bully or a disruptive/incompetent nepotism hire. And bad bosses make employees jump ship in a hurry. So, you’ll need to weed ineffective leaders and bullies out of the ranks if you want to reduce the outflow of good talent. This means investing in feedback surveys, providing leadership coaching to managers who need to improve, and maybe even throwing your old employee handbook out the window in favor of a more flexible common-sense approach.

Plan to provide a rich employment experience. Each employee should have a 12-to-18-month career development plan that gives them something to look forward to. If they feel adrift, they’ll hitch a ride with the first rescue boat that comes along.

Of course, no matter how good your talent management approach may be, you’ll still have people leave seeking greener pastures. It’s important to not see this as a betrayal worth burning a bridge over. Develop a process that makes it easier for those people to rejoin the company and save face. Talent development is just another opportunity to create a competitive advantage. Show your employees where they are on the succession chart and ask them about their career expectations. Offer well-funded training and development courses to employees who have mastered core position basics. And identify all the TBDs that define your expansion recruiting requirements. If you can increase the premium that your competitors must pay to recruit one of your employees, you can achieve the continuity necessary for real growth.